In a recent post, CoreLogic looked at the correlation between stocks and the sales of upper-end properties ($1 Million+ sales price). The report revealed:

"The

powerful 'wealth effects' generated by the rapid rise in equities between

2009 and 2015 drove a large rise in the sales of homes that sold for $1

million or more.

Historically, sales of homes priced $1 million or more averaged 1.2

percent of all home sales. The spread between high-end sales and equities

widened during the housing bubble but then moved more closely in unison. By

the time the equity markets had peaked in May 2015, the $1 million or more

share of the market had nearly doubled, averaging 2.2 percent for the

remainder of the year."

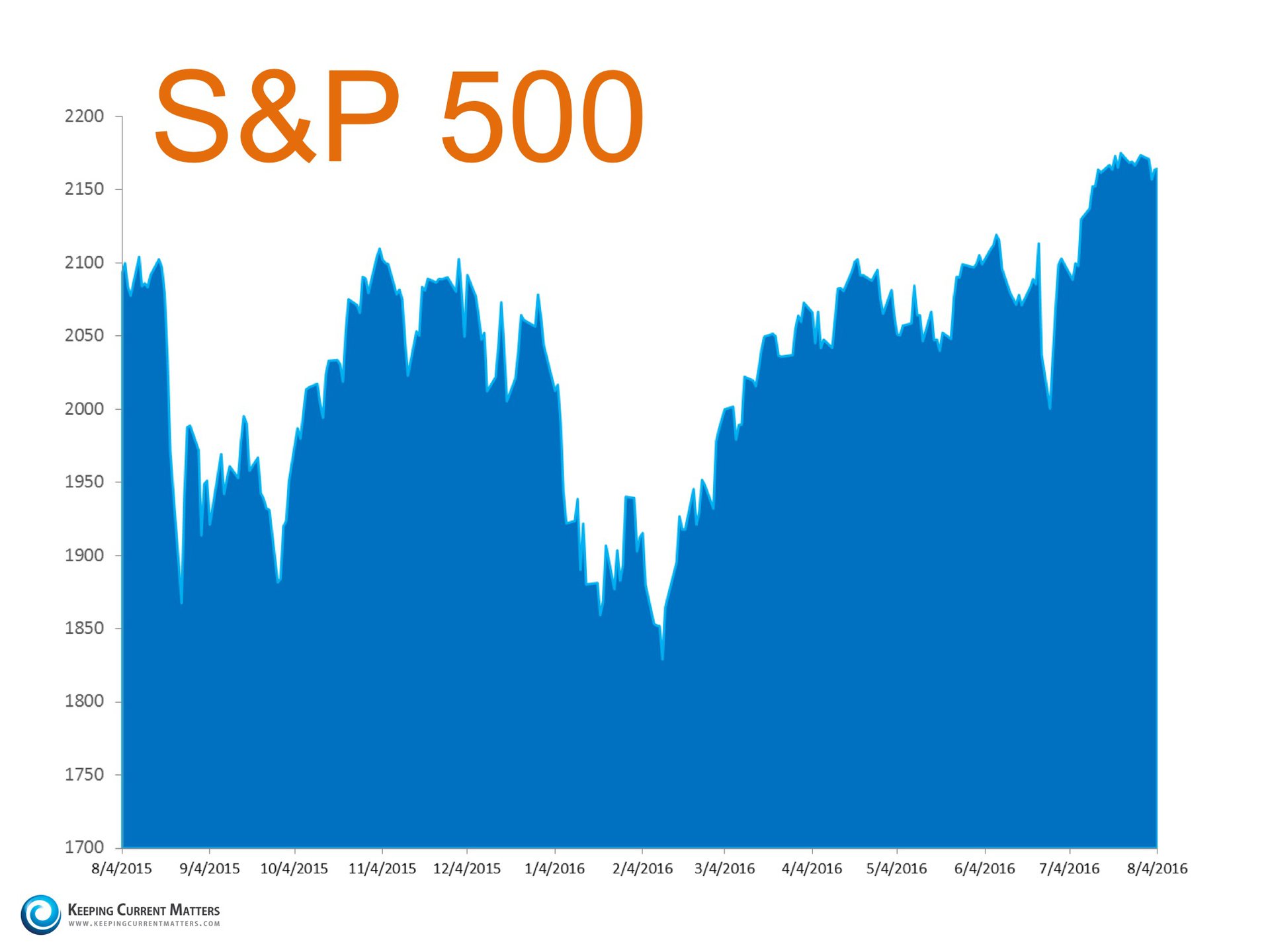

This

makes sense. As people see their wealth increasing, they feel more confident

in their purchasing power. And, of course, that would also impact their

decisions regarding real estate. The stock market dipped earlier this year

and there was quite a bit of anecdotal evidence that the upper-end market was

beginning to soften. As we can see in the chart below, the market is again

flourishing. That may rejuvenate the luxury market as we move through the

rest of the year.

As we proceed through 2016

and enter 2017, the strength of the stock market will be a key factor in the

strength of the luxury market. If the stock market falters, look for high-end

sales to slow. If the market advances, as it has shown signs of doing most

recently, the high-end market will advance. As we proceed through 2016

and enter 2017, the strength of the stock market will be a key factor in the

strength of the luxury market. If the stock market falters, look for high-end

sales to slow. If the market advances, as it has shown signs of doing most

recently, the high-end market will advance. |

Translate

Thursday, August 11, 2016

Luxury Home Sales & the Impact of the Stock Market

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment