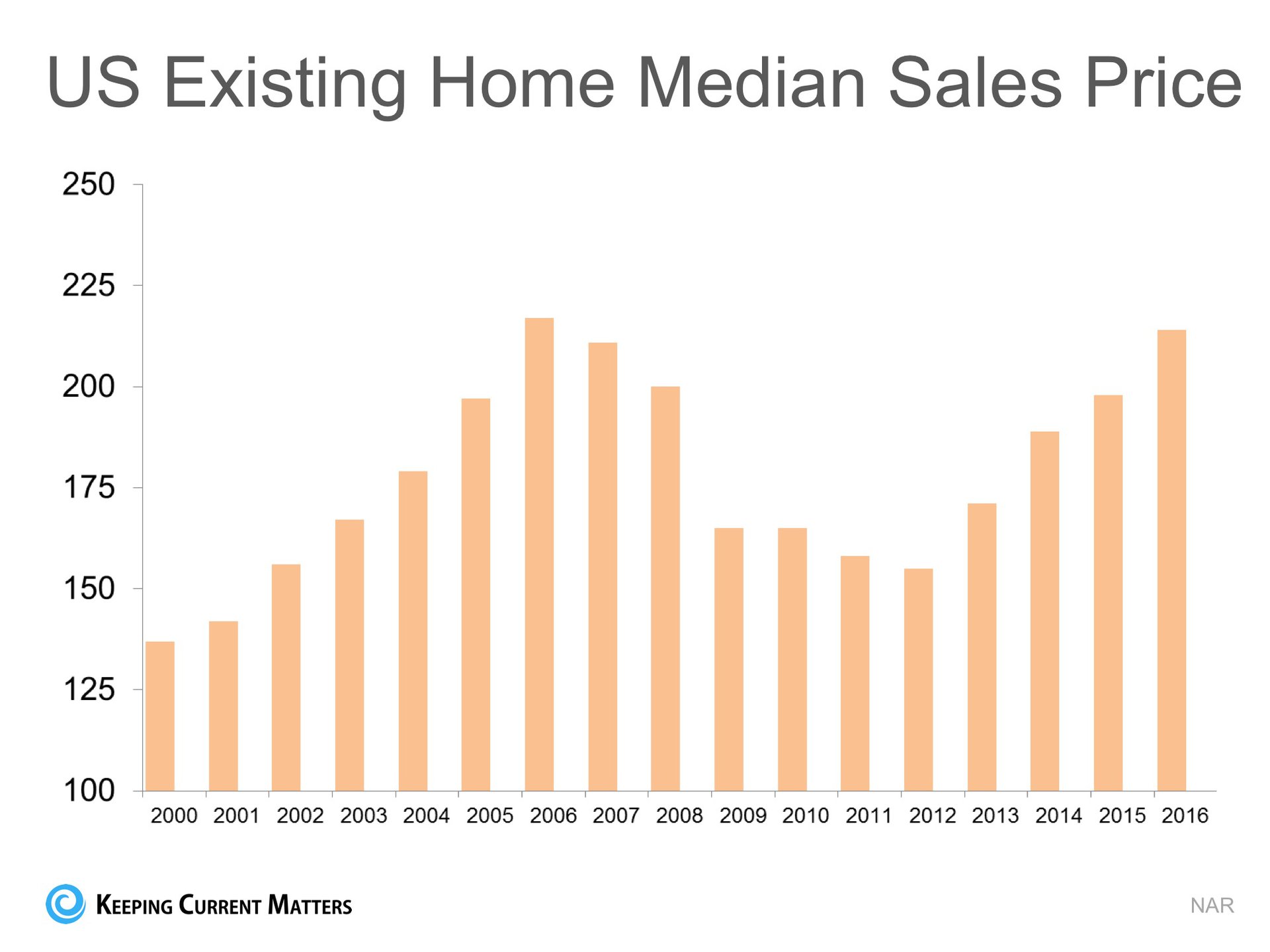

There are some industry pundits

claiming that residential home values have risen too quickly and that current

levels are on the verge of another housing bubble. It is easy to see how this

thinking has taken form if we look at a graph of home prices from 2000 to

today.

The graph definitely looks

like a rollercoaster ride. And, as prices begin to reach 2006 levels again,

it "seems logical" that the next part of the ride would be

downhill. However, this graph includes the anomaly of the price bubble and

the correction (the housing crash).

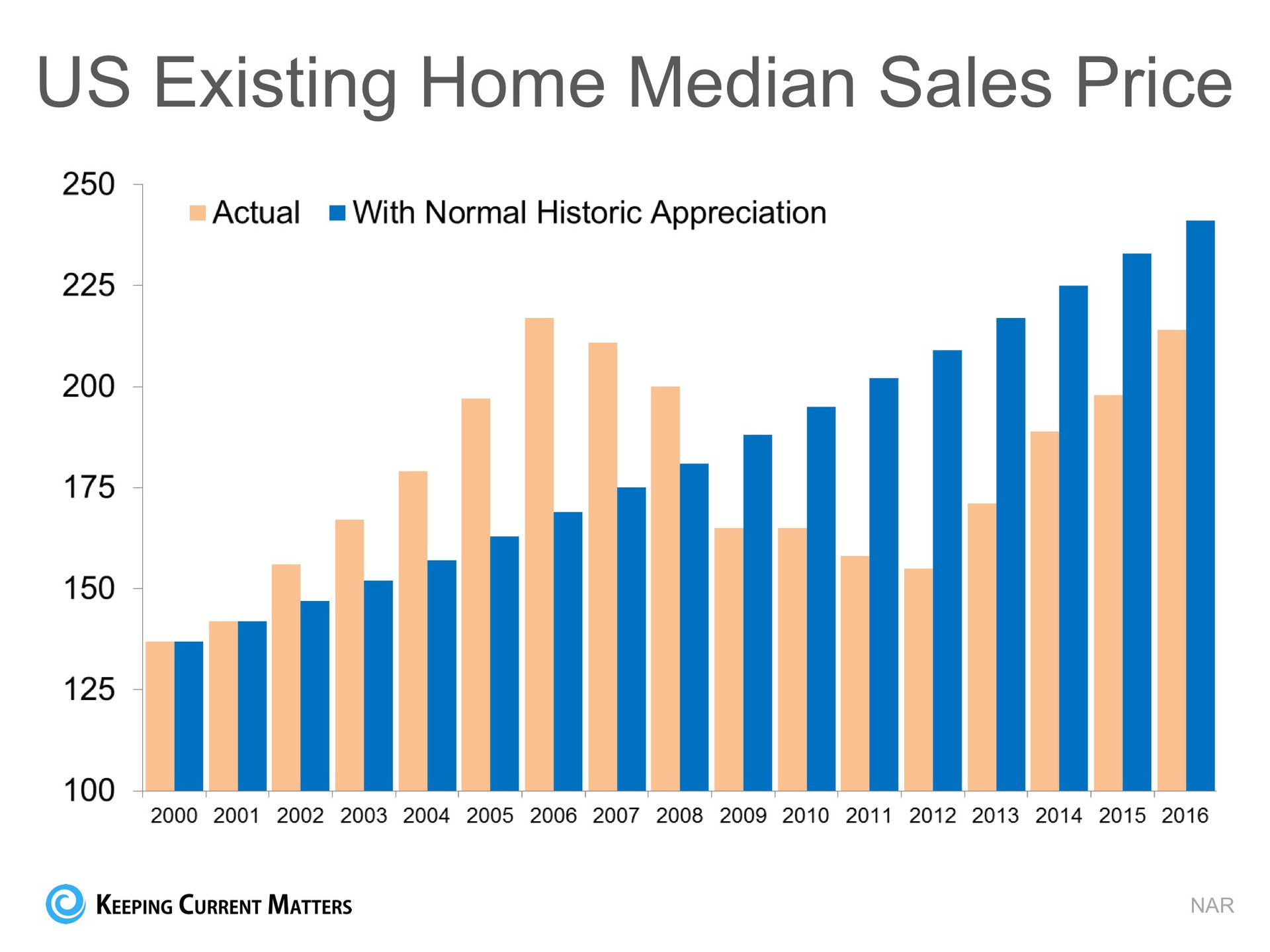

What if

the bubble & bust didn't occur?

Let's

assume that instead of the rise and fall in home prices that we saw last

decade, we just had normal historic appreciation from 2000 to today.

According to the 100+ experts that are surveyed for the Home Price

Expectation Survey, normal annual appreciation for residential single

family homes from 1987 to 1999 was 3.6%. Starting with the median home price

in 2000, we added 3.6% to it each year since then. Here is that graph

intermixed with the above graph.

What this shows us is

that, had the bubble and crash not occurred and instead we just had normal

annual appreciation over this period, prices would actually be greater than

they are today.

Bottom

Line

There

is no reason for alarm as prices seem to be right in line with where they

should be.

|

No comments:

Post a Comment