A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainty about the buying process. A specific cause for concern tends to be mortgage qualification. For many, the mortgage process can be scary, but it doesn't have to be!

In order to qualify in today's market, you'll need to have saved for a down payment (the average down payment on all loans was 11% last month, with many buyers putting down 3% or less), a stable income and good credit history. Throughout the entire home buying process, you will interact with many different professionals, all of which perform necessary roles. These professionals are also valuable resources for you. Once you're ready to apply, here are 5 easy steps that Freddie Mac suggests to follow:

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure that you are ready to take on the financial responsibilities of becoming a homeowner.

|

Translate

Monday, October 31, 2016

Taking the Fear out of the Mortgage Process

Friday, October 28, 2016

Buying a Home Can Be Scary... Know the Facts

Thursday, October 27, 2016

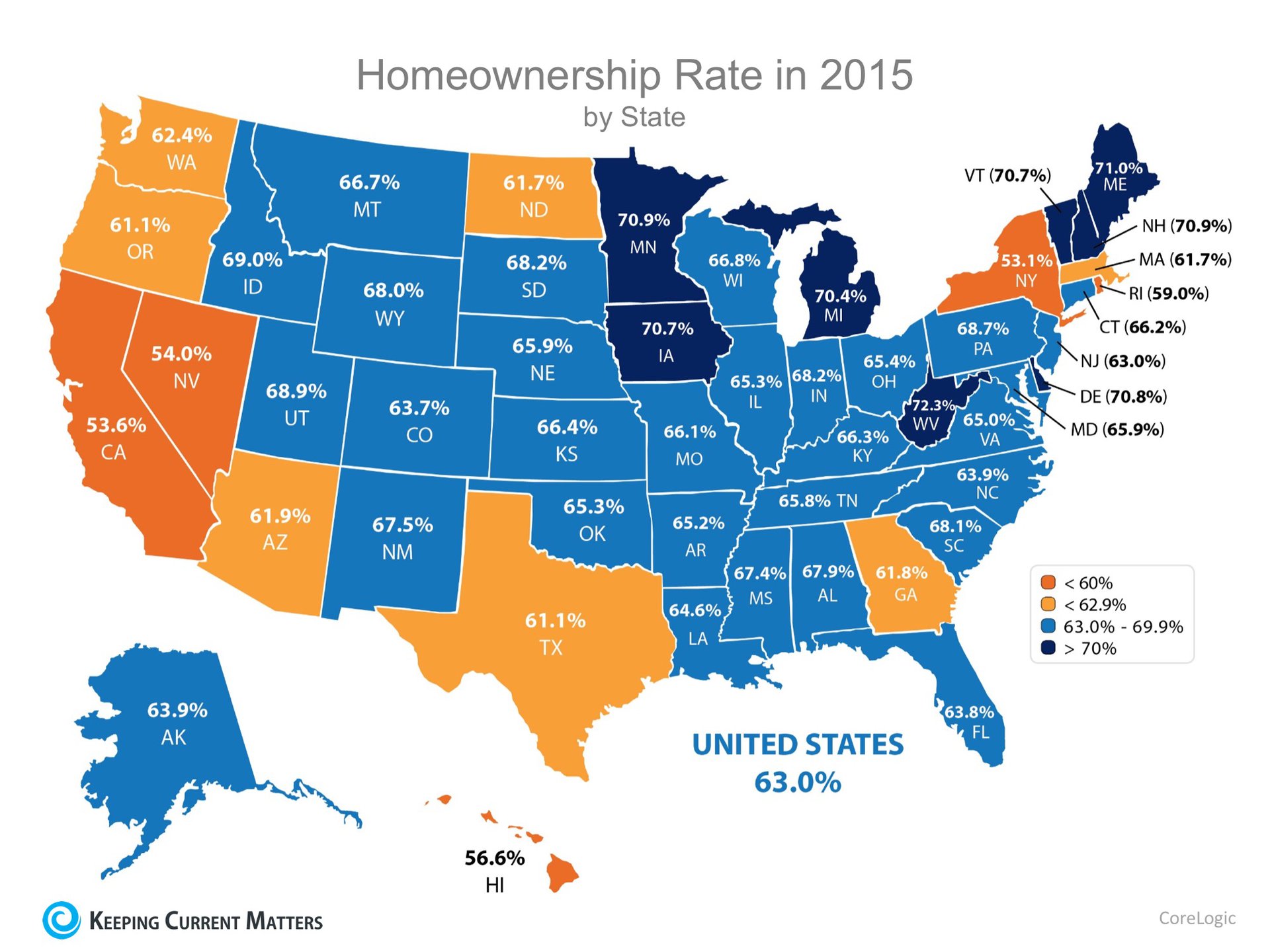

Percentage of Homeownership by Decade and by State

Subscribe to:

Posts (Atom)

![Buying a Home Can Be Scary... Know the Facts [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/10/20161028-ENG-KCM-1.jpg)