Do Homeowners Realize Their Equity Position Has Changed?

Yesterday, we reported

that according to CoreLogic's latest Equity Report, nearly 268,000

homeowners regained equity and are no longer underwater on their mortgage in

the first quarter. Homes with negative equity have decreased by 21.5%

year-over-year. A study

by Fannie Mae suggests that many homeowners are not aware of how

their equity position has changed as their home has increased in value. For

example, their study showed that 23% of Americans still believe their home is

in a negative equity position when, in actuality, CoreLogic's report

shows that only 8% of homes are in that position. The study also

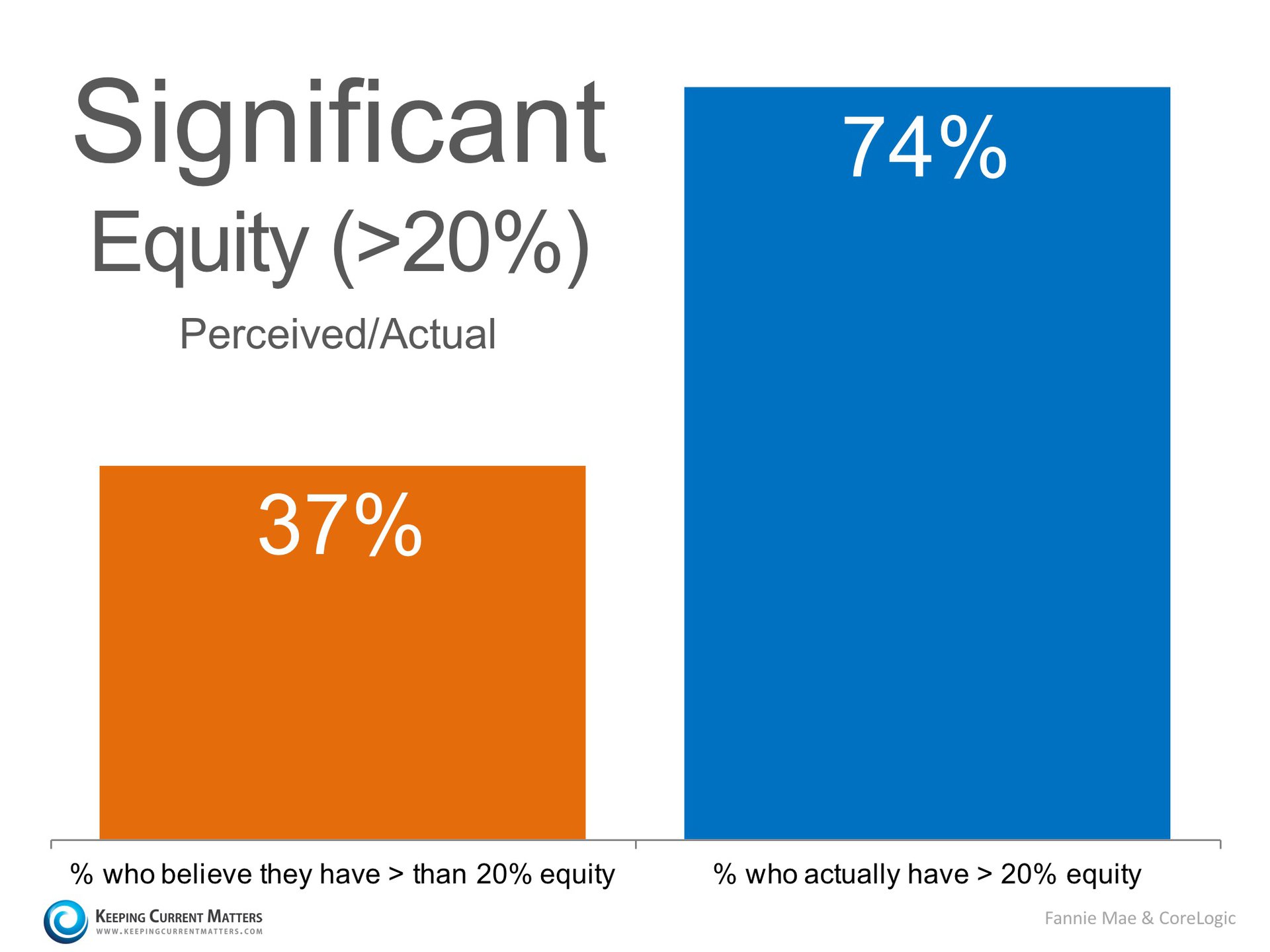

revealed that only 37% of Americans believe that they have "significant

equity" (greater than 20%), when in actuality, 74% do! Yesterday, we reported

that according to CoreLogic's latest Equity Report, nearly 268,000

homeowners regained equity and are no longer underwater on their mortgage in

the first quarter. Homes with negative equity have decreased by 21.5%

year-over-year. A study

by Fannie Mae suggests that many homeowners are not aware of how

their equity position has changed as their home has increased in value. For

example, their study showed that 23% of Americans still believe their home is

in a negative equity position when, in actuality, CoreLogic's report

shows that only 8% of homes are in that position. The study also

revealed that only 37% of Americans believe that they have "significant

equity" (greater than 20%), when in actuality, 74% do!  This means that 37% of

Americans with a mortgage fail to realize the opportune situation they are

in. With a sizable equity position, many homeowners could easily move into a

housing situation that better meets their current needs (moving to a larger

home or downsizing). Fannie Mae spoke out on this issue in their

report: This means that 37% of

Americans with a mortgage fail to realize the opportune situation they are

in. With a sizable equity position, many homeowners could easily move into a

housing situation that better meets their current needs (moving to a larger

home or downsizing). Fannie Mae spoke out on this issue in their

report:

"Homeowners

who underestimate their homes' values not only underestimate their home

equity, they also likely underestimate: 1) how large a down payment they

could make with their home equity, 2) their chances of qualifying for

mortgages, and, therefore, 3) their opportunities for selling their current

homes and for buying different homes."

CoreLogic's

report

also revealed that if homes were to appreciate by an additional 5%, over

800,000 US households would regain positive equity.

Bottom Line

If

you are one of the many homeowners who is unsure of your current equity

situation and would like to know your options, contact a local real estate

professional who can help.

|

No comments:

Post a Comment