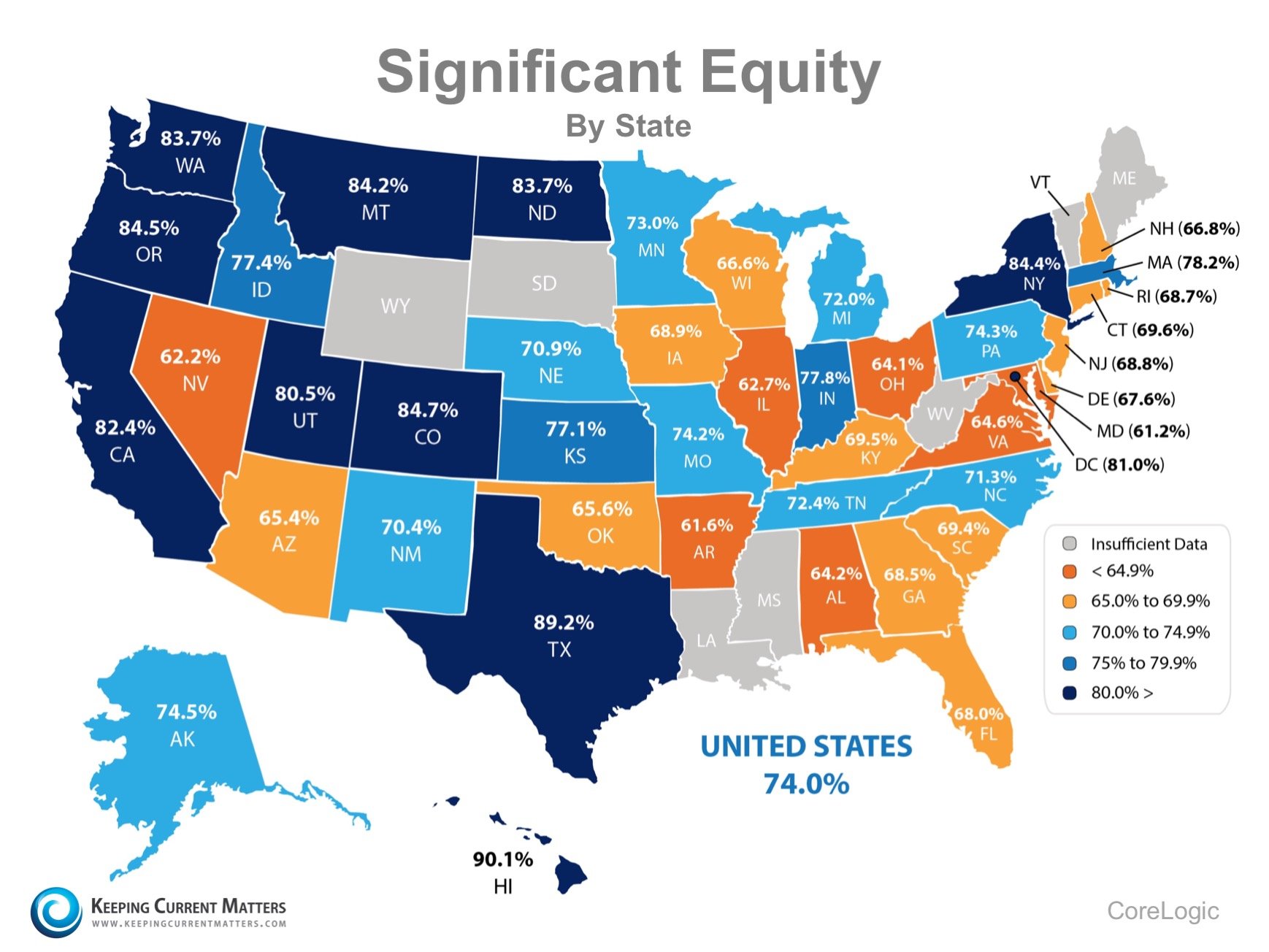

CoreLogic's latest Equity

Report revealed that 92% of all mortgaged properties are now in a

positive equity situation, while 74% now actually have significant equity (defined

as more than 20%)! The report also revealed that 268,000 households

regained equity in the first quarter of 2016 and are no longer under water. CoreLogic's latest Equity

Report revealed that 92% of all mortgaged properties are now in a

positive equity situation, while 74% now actually have significant equity (defined

as more than 20%)! The report also revealed that 268,000 households

regained equity in the first quarter of 2016 and are no longer under water.

Price

Appreciation = Good News for Homeowners

Frank

Nothaft, CoreLogic's Chief Economist, explains:

"In

just the last four years, equity for homeowners with a mortgage has nearly

doubled to $6.9 trillion. The rapid increase in home equity reflects the

improvement in home prices, dwindling distressed borrowers and increased

principal repayment. These are all positive factors that will provide support

to both household balance sheets and the overall economy."

Anand

Nallathambi, President & CEO of CoreLogic, believes this is a

great sign for the market in 2016 as well, as he had this to say:

"More

than 1 million homeowners have escaped the negative equity trap over the past

year. We expect this positive trend to continue over the balance of 2016 and

into next year as home prices continue to rise. Nationally, the CoreLogic

Home Price Index was up 5.5% year over year through the first quarter. If

home values rise another 5% uniformly across the U.S., the number of

underwater borrowers will fall by another one million during the next

year."

Below

is a map illustrating the percentage of households in each state with significant

equity:  Many homeowners with more

than 20% equity in their home would be able to use that equity as a down

payment on either a larger home or even a retirement home. Many homeowners with more

than 20% equity in their home would be able to use that equity as a down

payment on either a larger home or even a retirement home.

Bottom

Line

If

you are one of the many Americans who are unsure of how much equity you have

in your home, don't let that be the reason you fail to move on to your dream

home this year!

|

No comments:

Post a Comment